Explore the Wonders of Bhutan

Your ultimate guide to the enchanting land of Bhutan, offering insights into its culture, landscapes, and travel tips.

Crypto Market Volatility: Riding the Rollercoaster of Digital Currency

Discover the wild ups and downs of crypto market volatility! Join us for insider tips to navigate this thrilling digital currency rollercoaster.

Understanding the Causes of Crypto Market Volatility

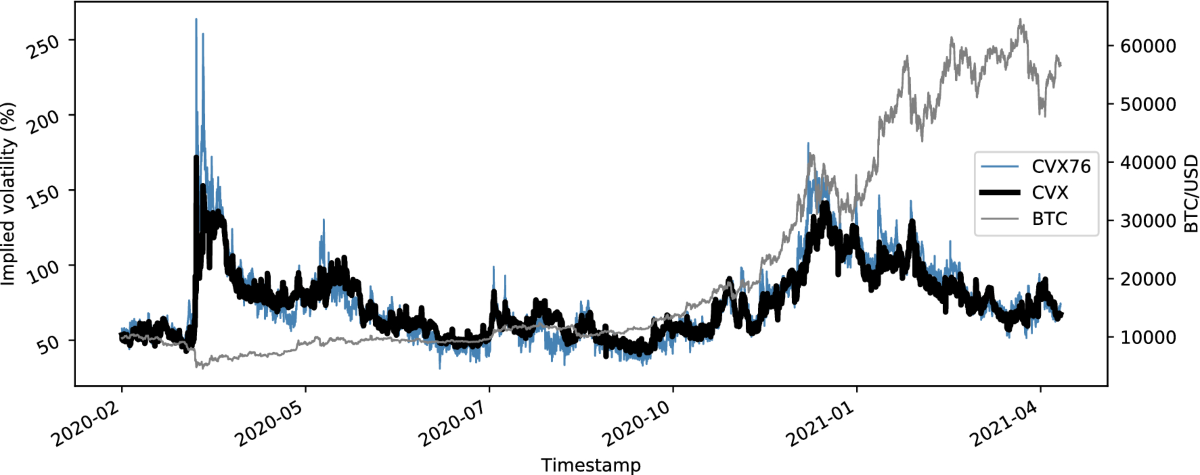

The crypto market is known for its significant fluctuations, often leading to both excitement and anxiety among investors. One of the primary causes of this volatility is the inherent speculative nature of cryptocurrencies, where prices can swing dramatically based on market sentiment rather than intrinsic value. Additionally, the relatively low market capitalization of many digital currencies contributes to exaggerated price movements—large trades can lead to substantial changes in price due to the limited liquidity available.

Another crucial factor influencing crypto market volatility is regulatory developments. Announcements or rumors regarding government regulations—whether positive or negative—can trigger swift reactions from traders. For instance, a country hinting at potential cryptocurrency regulations may lead to panic selling, while news of adoption by major financial institutions can drive prices upward. Furthermore, external events such as security breaches of crypto exchanges or significant technological upgrades to blockchain networks can also create uncertainty, contributing to the unpredictable nature of the market.

Counter-Strike is a popular first-person shooter game that has captivated millions of players worldwide. Teams compete in various game modes, using strategy and teamwork to achieve objectives. For those looking to enhance their gaming experience, consider using a cloudbet promo code for some exciting bonuses.

Top Strategies for Navigating the Wild Swings of Digital Currency

In the ever-evolving landscape of digital currency, navigating the wild swings of the market requires a combination of strategy and caution. One of the top strategies to employ is diversification. By spreading your investments across various cryptocurrencies, you can mitigate risks associated with the volatility of a single asset. Moreover, staying updated on market trends and news is essential. Subscribing to reputable crypto news platforms and joining community forums can provide invaluable insights, helping you make informed decisions.

Another effective strategy is to set clear investment goals and adhere to them, regardless of market fluctuations. This could involve determining your risk tolerance and setting stop-loss orders to protect your investments from sudden downturns. Additionally, consider the practice of dollar-cost averaging, which involves investing a fixed amount regularly, thus reducing the impact of price volatility over time. By implementing these strategies, you can position yourself to better handle the ups and downs of the digital currency market.

Is Investing in Cryptocurrency Worth the Risk?

In recent years, the rise of cryptocurrency has captured the attention of investors worldwide, prompting the question: Is investing in cryptocurrency worth the risk? With its promise of high returns, many are lured into the volatile market, yet it's crucial to understand the inherent risks. Cryptocurrencies are known for their wild price fluctuations, influenced by factors such as market sentiment, regulatory news, and technological advancements. As a result, potential investors need to conduct thorough research and consider if they can withstand the ups and downs of this digital asset class.

Before diving into the world of crypto, it's essential to evaluate the potential rewards against the risks. Key aspects to consider include:

- Market Volatility: Prices can swing dramatically, leading to potential gains or significant losses.

- Regulatory Landscape: Government regulations can impact the viability and value of certain cryptocurrencies.

- Security Concerns: Hacks and scams are not uncommon, highlighting the importance of securing investments.

Ultimately, while the opportunities in cryptocurrency can be enticing, investors should weigh these risks carefully to determine if investing in cryptocurrency aligns with their financial goals and risk tolerance.